Understanding FHA Student Loan Payments 2024: What You Need to Know

#### FHA Student Loan Payments 2024As we move into 2024, many students and recent graduates are looking to better understand the implications of FHA student……

#### FHA Student Loan Payments 2024

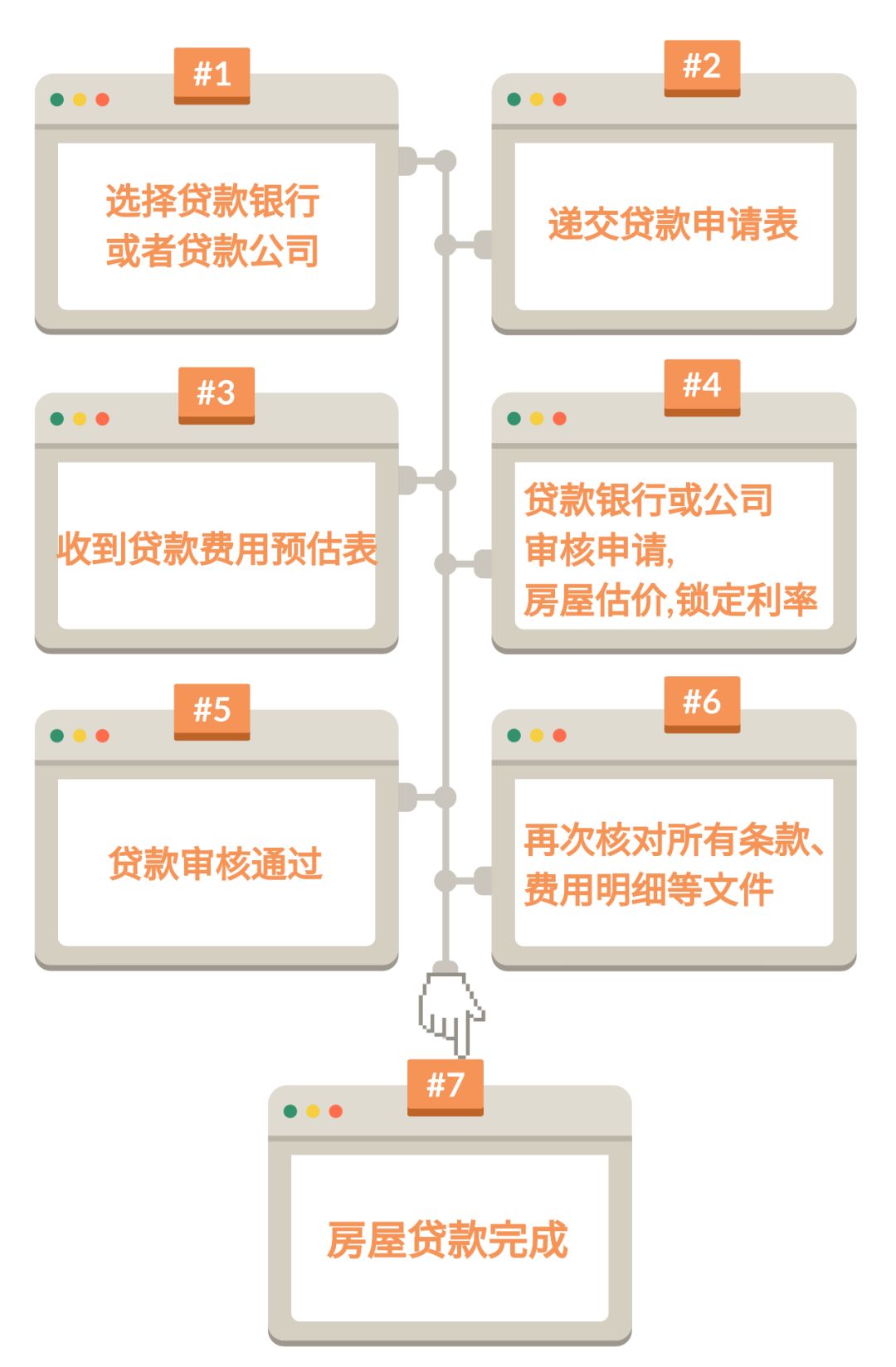

As we move into 2024, many students and recent graduates are looking to better understand the implications of FHA student loan payments. The Federal Housing Administration (FHA) provides loans that can help first-time homebuyers, including those with student loans, to secure financing. However, the presence of student loans can complicate the home-buying process, particularly when it comes to FHA loan eligibility and payment calculations.

#### What Are FHA Loans?

FHA loans are a type of mortgage insured by the Federal Housing Administration. They are designed to help lower-income and first-time homebuyers who may not qualify for conventional loans. One of the key benefits of FHA loans is the lower down payment requirement, which can be as low as 3.5%. However, when applying for an FHA loan, lenders will consider all of your debts, including student loans, to determine your debt-to-income (DTI) ratio.

#### Impact of Student Loans on FHA Loan Eligibility

In 2024, if you have student loans, it is essential to understand how they affect your FHA loan eligibility. Lenders typically look at your monthly student loan payments, even if you are currently in deferment or forbearance. This means that if you have a significant amount of student loan debt, it could impact your ability to qualify for an FHA loan.

For instance, if your student loan payments are high relative to your income, your DTI ratio may exceed the acceptable limits set by lenders. This could make it more challenging to secure the financing you need to purchase a home.

#### Calculating FHA Student Loan Payments

When calculating your FHA student loan payments for 2024, lenders will use either the actual payment amount or a percentage of your total student loan balance, depending on the loan type and your repayment plan. The most common method is to use 1% of your total student loan balance if you are not currently making payments. This can significantly impact your DTI ratio, so it's important to factor this into your financial planning.

#### Strategies for Managing FHA Student Loan Payments

To improve your chances of qualifying for an FHA loan in 2024, consider the following strategies:

1. **Income-Driven Repayment Plans**: If you are struggling with high monthly payments, consider enrolling in an income-driven repayment plan. These plans can lower your monthly payments based on your income, which can help improve your DTI ratio.

2. **Pay Down Your Loans**: If possible, make extra payments on your student loans to reduce the principal balance. This can lower your monthly payment amount and improve your overall financial picture.

3. **Consider Refinancing**: If you have private student loans, refinancing may offer lower interest rates and monthly payments. However, be cautious, as refinancing federal loans can result in losing certain protections.

4. **Consult a Financial Advisor**: If you're unsure about your options, consulting with a financial advisor who specializes in student loans and home buying can provide personalized guidance.

#### Conclusion

Understanding FHA student loan payments in 2024 is crucial for anyone looking to buy a home while managing student debt. By being proactive in managing your student loans and understanding how they impact your mortgage eligibility, you can position yourself for success in the home-buying process. Whether through income-driven repayment plans, paying down debt, or seeking professional advice, taking steps now can lead to better outcomes when you are ready to purchase your first home.