"Revolutionizing Finance: The Impact of Automated Loan Processing on Modern Banking"

#### Automated Loan ProcessingIn recent years, the financial industry has witnessed a significant transformation, primarily driven by technological advancem……

#### Automated Loan Processing

In recent years, the financial industry has witnessed a significant transformation, primarily driven by technological advancements. One of the most notable changes is the rise of **automated loan processing** systems. These systems have not only streamlined the loan application process but have also improved accuracy and customer satisfaction.

#### The Evolution of Loan Processing

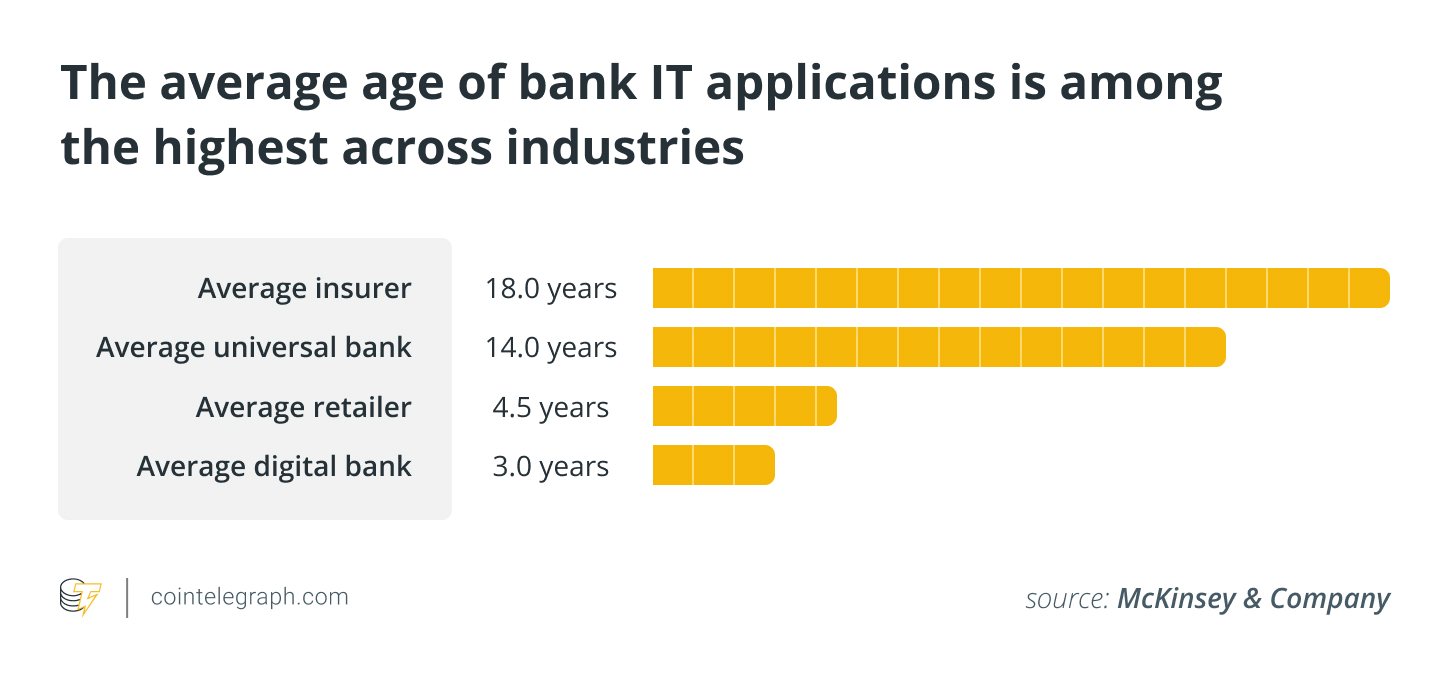

Traditionally, loan processing was a manual, labor-intensive task that involved numerous steps, including document verification, credit checks, and risk assessment. Each of these steps required human intervention, which often led to delays and errors. However, with the advent of **automated loan processing**, financial institutions can now manage these tasks more efficiently.

#### Benefits of Automated Loan Processing

One of the primary advantages of **automated loan processing** is the speed at which loans can be approved. Automated systems can analyze applications in real-time, significantly reducing the time it takes for borrowers to receive approval. This rapid response is crucial in today's fast-paced financial environment, where customers expect quick service.

Moreover, **automated loan processing** minimizes human error. By relying on algorithms and data analytics, financial institutions can make more informed decisions regarding loan approvals. This not only enhances the accuracy of the assessments but also reduces the risk of fraud, as automated systems can quickly identify discrepancies in documentation and credit history.

#### Enhancing Customer Experience

The customer experience has also improved dramatically due to **automated loan processing**. Borrowers can now complete applications online, upload necessary documents, and track their application status through user-friendly interfaces. This level of convenience is a significant departure from the traditional methods that often involved lengthy paperwork and in-person meetings.

Additionally, automated systems can provide personalized loan options based on a borrower’s financial profile. This tailored approach not only helps customers find the best loan products but also fosters a sense of trust and satisfaction with their financial institution.

#### Challenges and Considerations

Despite the numerous benefits, the implementation of **automated loan processing** is not without its challenges. Financial institutions must ensure that their systems are secure to protect sensitive customer data. Moreover, there is a need for transparency in how algorithms make decisions, as biases in programming can lead to unfair treatment of certain applicants.

Furthermore, while automation can enhance efficiency, it is essential to maintain a human touch in customer service. Automated systems should complement, not replace, the personal interactions that are often crucial in building customer relationships.

#### The Future of Automated Loan Processing

Looking ahead, the future of **automated loan processing** appears promising. As technology continues to evolve, we can expect even more sophisticated systems that leverage artificial intelligence and machine learning to make loan processing more efficient and accurate.

Financial institutions that embrace these advancements will likely gain a competitive edge, as they can offer faster, more reliable services to their customers. In conclusion, **automated loan processing** is not just a trend; it represents a fundamental shift in how the financial industry operates, paving the way for a more efficient, customer-centric approach to banking.