Unlocking the Benefits of an 84 Month Auto Loan Calculator: A Comprehensive Guide

Guide or Summary:Understanding the 84 Month Auto Loan CalculatorWhy Choose an 84 Month Auto Loan?How to Use the 84 Month Auto Loan CalculatorFactors to Cons……

Guide or Summary:

- Understanding the 84 Month Auto Loan Calculator

- Why Choose an 84 Month Auto Loan?

- How to Use the 84 Month Auto Loan Calculator

- Factors to Consider When Using an 84 Month Auto Loan Calculator

- Conclusion: Making the Most of Your 84 Month Auto Loan Calculator

Understanding the 84 Month Auto Loan Calculator

An 84 month auto loan calculator is an essential tool for anyone considering financing a vehicle over an extended period. This calculator allows potential car buyers to estimate their monthly payments based on the loan amount, interest rate, and loan term. By inputting these variables, users can gain insights into how much they will pay each month, making it easier to budget and plan for their new purchase.

Why Choose an 84 Month Auto Loan?

Choosing an 84 month auto loan can have several advantages. One of the primary benefits is the lower monthly payments compared to shorter loan terms. By spreading the loan amount over a longer period, buyers can enjoy more manageable payments, which can be particularly helpful for those on a tighter budget. This flexibility allows individuals to allocate their finances more effectively, potentially leaving room for other expenses or savings.

However, it’s essential to consider the trade-offs. While the lower monthly payments are appealing, longer loan terms typically result in higher overall interest paid over the life of the loan. This is where the 84 month auto loan calculator becomes invaluable, as it can help users visualize the total cost of financing their vehicle, enabling informed decisions.

How to Use the 84 Month Auto Loan Calculator

Using an 84 month auto loan calculator is straightforward. Here’s a step-by-step guide:

1. **Input the Loan Amount**: Start by entering the total amount you wish to borrow. This is often the price of the vehicle minus any down payment or trade-in value.

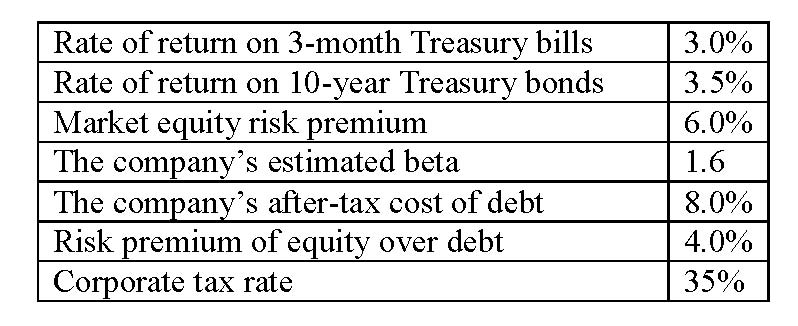

2. **Enter the Interest Rate**: Input the annual percentage rate (APR) offered by the lender. This rate can vary based on credit scores and market conditions.

3. **Select the Loan Term**: Ensure you set the loan term to 84 months. This is crucial for calculating the monthly payments accurately.

4. **Calculate**: Hit the calculate button to see your estimated monthly payment, total interest paid, and total repayment amount.

By playing around with different loan amounts and interest rates, users can find the most suitable financing option for their needs.

Factors to Consider When Using an 84 Month Auto Loan Calculator

While the 84 month auto loan calculator is a powerful tool, users should also consider several factors before committing to a loan:

- **Interest Rates**: Ensure you shop around for the best interest rates. Even a small difference in rates can significantly impact the total cost of the loan.

- **Total Loan Cost**: Look beyond monthly payments. The total cost of the loan over 84 months can be substantial, so understanding the full financial commitment is crucial.

- **Vehicle Depreciation**: Cars depreciate quickly, and financing a vehicle over a longer term may result in owing more than the car is worth, especially if it’s a new vehicle.

- **Financial Stability**: Assess your financial situation to ensure you can comfortably afford the monthly payments over the loan term.

Conclusion: Making the Most of Your 84 Month Auto Loan Calculator

In conclusion, an 84 month auto loan calculator is a valuable resource for potential car buyers. It provides clarity and insight into the financial implications of financing a vehicle over an extended period. By understanding how to use this calculator effectively and considering the associated factors, individuals can make informed decisions that align with their financial goals. Whether you’re looking for lower monthly payments or exploring your financing options, the 84 month auto loan calculator can help you navigate the complexities of auto loans with confidence.