Understanding What Car Loan Interest Rate You Should Expect in 2023

#### What Car Loan Interest RateWhen considering purchasing a vehicle, one of the most critical factors to evaluate is the car loan interest rate. Understan……

#### What Car Loan Interest Rate

When considering purchasing a vehicle, one of the most critical factors to evaluate is the car loan interest rate. Understanding what car loan interest rate you should expect can significantly influence your overall financial commitment. In 2023, the landscape of car financing has evolved, and knowing the current trends can help you make informed decisions.

#### Factors Influencing Car Loan Interest Rates

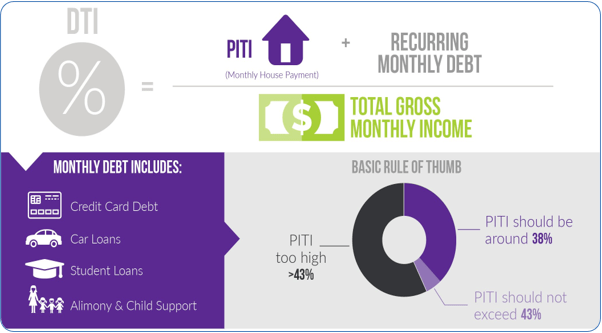

Several factors can affect the interest rates offered by lenders. These include your credit score, the type of vehicle you're purchasing, the loan term, and the overall economic climate. Generally, individuals with higher credit scores will qualify for lower interest rates. This is because lenders view them as less risky. If your credit score is below average, you may face higher interest rates, which can add thousands of dollars to the total cost of the loan over time.

Additionally, the type of vehicle plays a role. New cars typically come with lower interest rates compared to used cars. Lenders often see new cars as less risky investments because they have a higher resale value. Furthermore, the length of the loan term can also impact the interest rate. While longer terms may result in lower monthly payments, they often come with higher overall interest costs.

#### Current Trends in Car Loan Interest Rates

As of 2023, car loan interest rates have been fluctuating due to various economic factors. With inflation rates impacting the cost of borrowing, many lenders have adjusted their rates accordingly. On average, you might expect to see rates ranging from 4% to 7% for new cars, while used car loans might hover slightly higher, around 5% to 9%.

It's essential to shop around and compare offers from different lenders. Online calculators can help you estimate monthly payments based on varying interest rates, loan amounts, and terms. This can provide a clearer picture of what car loan interest rate you should aim for based on your financial situation.

#### How to Secure the Best Car Loan Interest Rate

To secure the best possible interest rate, consider taking the following steps:

1. **Check Your Credit Score**: Before applying for a loan, check your credit report and score. If there are any inaccuracies, rectify them. A higher score can lead to better rates.

2. **Research Lenders**: Different lenders offer different rates. Consider banks, credit unions, and online lenders. Each may have unique benefits and competitive rates.

3. **Get Pre-Approved**: Pre-approval can give you a better idea of what rates you qualify for before you start shopping for a car. This process can also strengthen your negotiating position with dealerships.

4. **Negotiate**: Don’t hesitate to negotiate the interest rate. Many dealerships have flexibility in their financing options, and you may be able to lower your rate by presenting competing offers.

5. **Consider a Larger Down Payment**: A larger down payment can reduce the amount you need to finance, which can lead to a lower interest rate.

#### Conclusion

Understanding what car loan interest rate you should expect is crucial for making a smart financial decision when purchasing a vehicle. By considering the various factors that influence interest rates, staying informed about current trends, and following best practices to secure the best rate, you can minimize your overall loan costs. Always remember to do thorough research and consider all your options before committing to a loan.