Understanding the Differences: Stafford Loan vs Direct Loan - Which One is Right for You?

#### Stafford Loan vs Direct LoanWhen it comes to financing your education, understanding the various loan options available is crucial. Two prominent types……

#### Stafford Loan vs Direct Loan

When it comes to financing your education, understanding the various loan options available is crucial. Two prominent types of federal student loans are the Stafford Loan and the Direct Loan. While often used interchangeably, they have distinct differences that can significantly impact your financial future. In this article, we will explore the nuances of Stafford Loan vs Direct Loan, helping you make an informed decision for your educational funding needs.

#### What is a Stafford Loan?

The Stafford Loan, also known as the William D. Ford Federal Direct Loan Program, is a federal student loan designed to help students cover the cost of their education. Stafford Loans can be either subsidized or unsubsidized. Subsidized Stafford Loans are available to undergraduate students who demonstrate financial need, and the government pays the interest while the student is in school. On the other hand, unsubsidized Stafford Loans are available to all students regardless of financial need, but the borrower is responsible for all interest that accrues during school.

#### What is a Direct Loan?

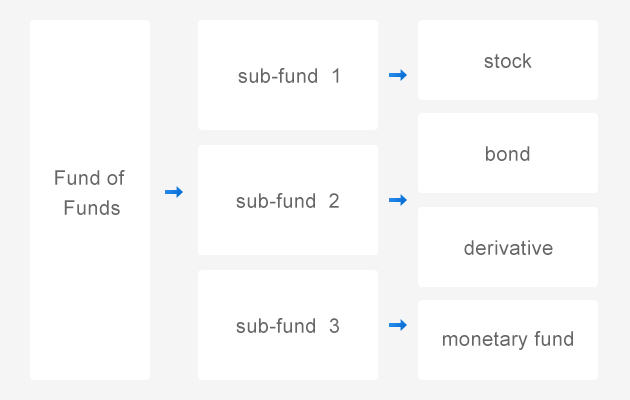

The term "Direct Loan" refers to the federal Direct Loan Program, which includes several types of loans, including the Stafford Loan. Therefore, when discussing Stafford Loan vs Direct Loan, it's important to note that Stafford Loans fall under the umbrella of Direct Loans. The Direct Loan program offers various loan types such as Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for graduate students and parents, and Direct Consolidation Loans.

#### Key Differences Between Stafford Loan and Direct Loan

1. **Loan Types**: As mentioned, Stafford Loans are a subset of Direct Loans. While Stafford Loans specifically refer to subsidized and unsubsidized loans for undergraduate and graduate students, Direct Loans encompass a broader range of options, including PLUS loans and consolidation loans.

2. **Eligibility Requirements**: Stafford Loans are primarily aimed at students, with eligibility based on financial need for subsidized loans. Direct Loans, including PLUS loans, are available to parents and graduate students, expanding the borrowing options for families.

3. **Interest Rates**: Both Stafford Loans and Direct Loans typically have fixed interest rates, but the rates may differ based on the type of loan and the disbursement year. It’s essential to check the current rates when considering your options.

4. **Repayment Options**: Both Stafford and Direct Loans offer various repayment plans, including income-driven repayment options. However, the specifics of the repayment terms may vary based on the loan type and the borrower's circumstances.

5. **Loan Limits**: Stafford Loans have specific borrowing limits based on the student's year in school and whether they are dependent or independent. Direct Loans, especially PLUS loans, may allow for higher borrowing limits, especially for graduate students.

#### Conclusion: Which Loan is Right for You?

Deciding between Stafford Loan vs Direct Loan ultimately depends on your specific situation, including your financial needs, the type of education you are pursuing, and your long-term financial goals. If you are an undergraduate student with demonstrated financial need, a subsidized Stafford Loan may be the best option. However, if you are a graduate student or a parent looking to finance education expenses, exploring Direct Loans, including PLUS loans, could be more beneficial.

In conclusion, understanding the differences between Stafford Loans and Direct Loans is essential for making informed financial decisions regarding your education. Always consider your personal circumstances, consult with financial aid advisors, and thoroughly research your options before committing to any loan. By doing so, you can ensure that you choose the best financing path for your educational journey.