How to Sell a Car with a Loan on It: A Step-by-Step Guide to Unlocking Your Vehicle's Value

#### IntroductionSelling a car with a loan on it can seem daunting, but with the right approach, you can navigate the process smoothly and maximize your veh……

#### Introduction

Selling a car with a loan on it can seem daunting, but with the right approach, you can navigate the process smoothly and maximize your vehicle's value. In this comprehensive guide, we will delve into the steps you need to take to sell your car while still under loan obligations. Whether you're looking to upgrade your vehicle or simply need to offload it for financial reasons, understanding how to sell a car with a loan on it is crucial.

#### Understanding Your Loan Situation

Before you start the selling process, it’s important to understand the specifics of your loan. Contact your lender to get the payoff amount, which is the total amount you owe on the car. This figure will help you determine how much you can sell the car for and whether you might need to cover any difference out of pocket.

#### Assessing Your Car's Value

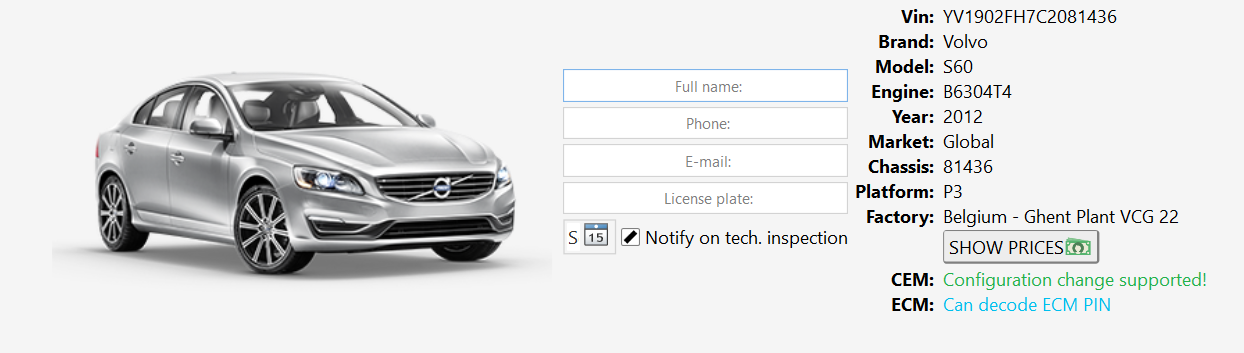

To effectively sell your car, you need to know its market value. Use online tools like Kelley Blue Book or Edmunds to get an estimate based on your car's make, model, year, and condition. This information will guide you in setting a competitive price that attracts buyers while ensuring that you can pay off your loan.

#### Gathering Necessary Documentation

When selling a car with a loan, having all the required paperwork is essential. Gather the following documents:

1. **Title**: If your lender holds the title, they will need to be involved in the sale.

2. **Loan Payoff Statement**: This document provides the exact amount needed to pay off your loan.

3. **Vehicle History Report**: A report from services like Carfax can reassure potential buyers about the car's condition.

4. **Maintenance Records**: Showing that you've maintained the vehicle can enhance its value.

#### Choosing the Right Selling Method

You have several options for selling your car:

- **Private Sale**: Selling to an individual can yield a higher price, but it requires more effort in terms of marketing and negotiation.

- **Dealership Trade-In**: If you're purchasing a new vehicle, trading in your car can simplify the process, though you might get less money.

- **Online Car Buying Services**: Companies like Carvana or Vroom can provide quick offers, but be sure to check if they handle loans.

#### Communicating with Your Lender

Once you have a buyer, inform your lender about the sale. If the sale price is enough to cover the loan payoff, the process will be straightforward. If the sale price is lower than what you owe, you’ll need to discuss options with your lender, which may include covering the difference or rolling the remaining balance into a new loan.

#### Completing the Sale

When you have a buyer ready to purchase, follow these steps:

1. **Negotiate the Price**: Be prepared to negotiate, but stay firm on your minimum acceptable price based on your loan payoff.

2. **Finalize Payment**: Arrange for payment in a secure manner, such as a cashier's check or bank transfer.

3. **Pay Off the Loan**: Use the funds from the sale to pay off your loan, and request the lender to release the title.

4. **Transfer Ownership**: Complete the necessary paperwork to transfer the title to the new owner, ensuring they receive all relevant documents.

#### Conclusion

Selling a car with a loan on it doesn’t have to be a complicated process. By following the steps outlined in this guide, you can effectively manage your loan situation and successfully sell your vehicle. Remember to communicate openly with your lender and potential buyers, and always ensure that all paperwork is in order. With the right preparation, you can unlock the value of your car while fulfilling your financial obligations.