Quick Loans No Credit: Your Ultimate Guide to Fast Financial Solutions

#### Description:In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals searching for immediate solutions. If y……

#### Description:

In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals searching for immediate solutions. If you find yourself in need of quick cash but have a less-than-perfect credit score, quick loans no credit can be a viable option to consider. This guide aims to provide you with valuable insights into what quick loans are, how they work, and the benefits they offer, especially for those with poor credit histories.

Quick loans, often referred to as personal loans or payday loans, are designed to provide borrowers with fast access to funds. These loans typically have a short repayment term, which can range from a few weeks to a few months. One of the most appealing aspects of quick loans no credit is that they often do not require a credit check, making them accessible to individuals who may have been turned away by traditional lenders.

The application process for quick loans no credit is generally straightforward and can often be completed online. Borrowers usually need to provide basic personal information, including their name, address, income, and employment details. Many lenders also require proof of income to ensure that borrowers can repay the loan. Once the application is submitted, most lenders provide a decision within minutes, allowing you to receive funds as quickly as the same day or within 24 hours.

One of the significant advantages of quick loans no credit is the speed at which you can obtain funds. Unlike traditional loans that may take days or even weeks to process, these loans are designed for urgent financial needs. Whether you need to cover unexpected medical bills, car repairs, or urgent home expenses, these loans can provide the financial relief you need without the long wait.

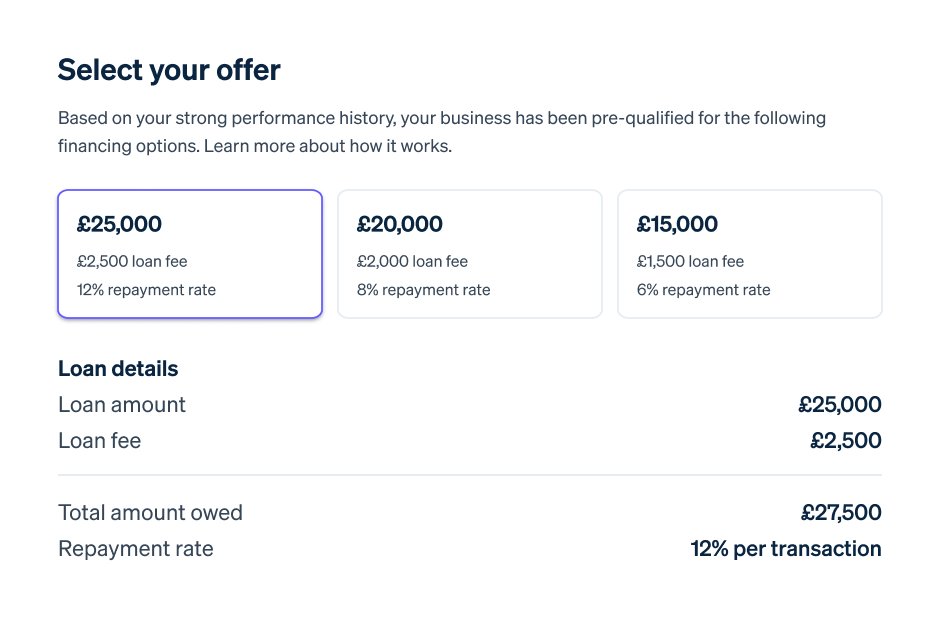

However, it’s essential to approach quick loans no credit with caution. Due to the lack of credit checks, lenders often charge higher interest rates compared to traditional loans. This means that while you can access money quickly, you may end up paying significantly more in interest and fees over time. Therefore, it’s crucial to carefully read the terms and conditions before committing to any loan.

Another important consideration is the repayment terms. Many quick loans require repayment in a lump sum, which can be challenging if you’re already facing financial difficulties. Some lenders offer flexible repayment options, allowing you to break the payment into installments, but these may come with higher fees. Always assess your budget and ensure that you can comfortably make the repayments without falling deeper into debt.

To mitigate the risks associated with quick loans no credit, it’s advisable to explore all available options. Consider reaching out to local charities, community organizations, or even family and friends who may be able to assist you without the burden of high-interest rates. Additionally, some credit unions offer small loans with more favorable terms for individuals with poor credit, so it’s worth investigating these alternatives.

If you decide to proceed with a quick loan no credit, it’s essential to shop around. Different lenders have varying terms, interest rates, and fees, so taking the time to compare offers can save you money in the long run. Look for reputable lenders with positive reviews and transparent practices to ensure that you’re making a sound financial decision.

In conclusion, quick loans no credit can be a helpful financial tool in times of need, providing fast access to cash without the barriers of credit checks. However, it’s crucial to understand the implications of such loans, including high-interest rates and repayment challenges. By conducting thorough research and considering all available options, you can make informed decisions that align with your financial goals and help you navigate your financial challenges effectively. Remember, while quick loans can offer immediate relief, responsible borrowing and repayment practices are essential for long-term financial health.