Low Credit Score Debt Consolidation Loans: A Comprehensive Guide to Securing Your Financial Future

Guide or Summary:Understanding Low Credit Score Debt Consolidation LoansWhy Choose Low Credit Score Debt Consolidation Loans?How to Secure a Low Credit Scor……

Guide or Summary:

- Understanding Low Credit Score Debt Consolidation Loans

- Why Choose Low Credit Score Debt Consolidation Loans?

- How to Secure a Low Credit Score Debt Consolidation Loan

- Post-Approval: Managing Your Low Credit Score Debt Consolidation Loan

- Conclusion: Embracing Your Financial Future with Low Credit Score Debt Consolidation Loans

In the ever-evolving financial landscape, managing debt has become an increasingly complex task for many individuals. For those grappling with a low credit score, the prospect of consolidating debt can seem daunting, yet it holds the promise of financial stability and a path to a brighter financial future. This comprehensive guide delves into the intricacies of low credit score debt consolidation loans, offering insights into how these financial instruments can be leveraged to achieve long-term financial success.

Understanding Low Credit Score Debt Consolidation Loans

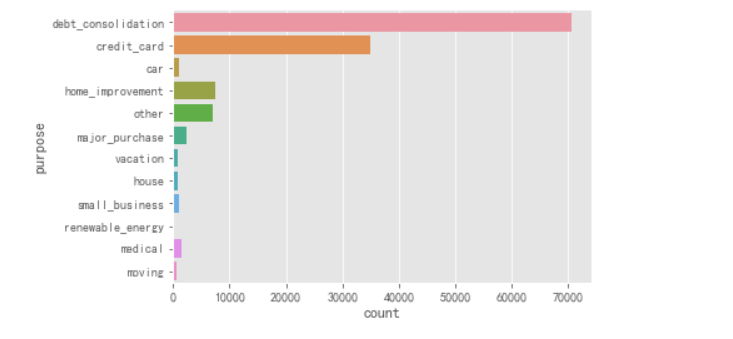

At its core, debt consolidation involves combining multiple debts into a single, manageable payment. This process simplifies repayment, reduces interest rates, and provides a clear roadmap for becoming debt-free. Low credit score debt consolidation loans specifically cater to borrowers with a credit score below 600, offering them a lifeline when traditional financing options are inaccessible.

Why Choose Low Credit Score Debt Consolidation Loans?

The primary appeal of low credit score debt consolidation loans lies in their accessibility. Traditional lenders often require a credit score of 620 or higher to approve a loan, making it challenging for those with lower scores to secure financing. Low credit score debt consolidation loans, on the other hand, are designed to bridge this gap, providing a viable option for individuals with credit scores below 600.

Moreover, these loans typically offer competitive interest rates, making them an attractive choice for consolidating high-interest debts. By combining multiple debts into a single loan, borrowers can reduce their monthly payments and save on interest charges, ultimately paying off their debts faster and with less financial strain.

How to Secure a Low Credit Score Debt Consolidation Loan

Securing a low credit score debt consolidation loan requires a strategic approach. Borrowers should start by assessing their financial situation, including their income, expenses, and existing debts. This step is crucial for determining the amount they can afford to borrow and the repayment terms that are feasible.

Next, borrowers should research and compare lenders offering low credit score debt consolidation loans. It's essential to consider factors such as interest rates, fees, and repayment terms when making this decision. Additionally, borrowers should be aware of the eligibility criteria and documentation required by different lenders, ensuring they meet these requirements before applying.

Once a suitable lender is identified, borrowers should proceed with the application process. This typically involves submitting personal and financial information, as well as providing documentation to support their creditworthiness. Borrowers should also be prepared to negotiate the terms of the loan if necessary, ensuring they secure the best possible deal.

Post-Approval: Managing Your Low Credit Score Debt Consolidation Loan

After securing a low credit score debt consolidation loan, it's crucial to manage it effectively. Borrowers should adhere to the repayment schedule, making timely payments to avoid late fees and damaging their credit score further. They should also monitor their spending habits, ensuring they live within their means and avoid accumulating new debts.

For those struggling to make payments, there are options available, such as forbearance or deferment, which can provide temporary relief. However, borrowers should approach these options carefully, understanding the implications for their repayment schedule and financial goals.

Conclusion: Embracing Your Financial Future with Low Credit Score Debt Consolidation Loans

Low credit score debt consolidation loans offer a lifeline to individuals grappling with debt and a low credit score. By understanding the benefits and strategic approach required to secure these loans, borrowers can take control of their financial future, reducing debt, and building a more stable financial foundation. With the right planning and management, low credit score debt consolidation loans can be a powerful tool in achieving long-term financial success.