"Understanding Business Loan Interest Rates Today: A Comprehensive Guide for Entrepreneurs"

#### Business Loan Interest Rates TodayIn today's competitive business landscape, understanding business loan interest rates today is crucial for entreprene……

#### Business Loan Interest Rates Today

In today's competitive business landscape, understanding business loan interest rates today is crucial for entrepreneurs seeking financing options. With fluctuating economic conditions, these interest rates can significantly impact your business's financial health. This guide will explore the factors influencing current rates, how to secure the best terms, and what to expect in the future.

#### Factors Influencing Business Loan Interest Rates

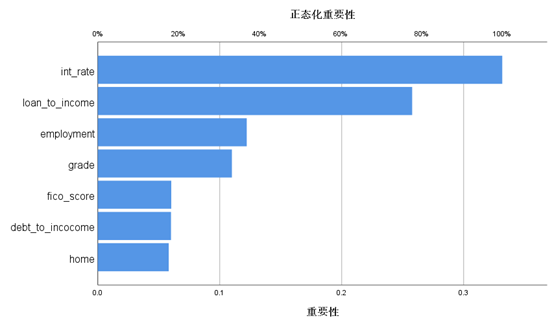

Several key factors determine business loan interest rates today. One of the primary influences is the overall economic environment. When the economy is thriving, interest rates tend to rise as lenders become more confident in borrowers' ability to repay loans. Conversely, during economic downturns, rates may decrease to encourage borrowing and stimulate growth.

Another significant factor is the creditworthiness of the business seeking the loan. Lenders assess the borrower's credit score, financial history, and business performance to determine risk. A higher credit score typically results in lower interest rates, while a lower score may lead to higher rates or even loan denial.

Additionally, the type of loan and its term length can affect the interest rate. Short-term loans often carry higher rates due to the increased risk for lenders, while long-term loans may offer more favorable rates as they provide a more extended repayment period.

#### How to Secure the Best Business Loan Interest Rates Today

To secure the best business loan interest rates today, entrepreneurs should take several proactive steps. First, it is essential to maintain a strong credit score by paying bills on time, reducing debt, and avoiding new credit inquiries before applying for a loan.

Next, shop around and compare offers from multiple lenders. Different financial institutions may have varying rates and terms, so it's beneficial to explore options from banks, credit unions, and alternative lenders. Use online tools and calculators to estimate potential loan costs and interest rates.

Additionally, consider improving your business's financial health before applying for a loan. This may involve increasing revenue, reducing expenses, or providing detailed financial statements that demonstrate your business's stability and growth potential. A well-prepared business plan can also help convince lenders of your ability to repay the loan.

#### What to Expect in the Future

Looking ahead, the landscape of business loan interest rates today may continue to evolve based on various economic indicators. Factors such as inflation rates, changes in the Federal Reserve's monetary policy, and global economic conditions will play a significant role in shaping interest rates.

Entrepreneurs should stay informed about market trends and be prepared to adapt their borrowing strategies accordingly. By understanding the dynamics of interest rates and remaining proactive in their financial planning, business owners can position themselves for success in securing favorable loan terms.

In conclusion, grasping the intricacies of business loan interest rates today is essential for any entrepreneur looking to finance their venture. By being informed and prepared, you can navigate the borrowing landscape effectively and make sound financial decisions that foster your business's growth and sustainability.