How to Become a Commercial Loan Broker: A Comprehensive Guide to Launching Your Career in Commercial Financing

#### How to Become a Commercial Loan BrokerBecoming a commercial loan broker can be a rewarding career choice for those interested in finance and helping bu……

#### How to Become a Commercial Loan Broker

Becoming a commercial loan broker can be a rewarding career choice for those interested in finance and helping businesses secure the funding they need to grow. This guide will provide you with a detailed roadmap on how to become a commercial loan broker, covering the essential steps, skills, and knowledge required to succeed in this competitive field.

#### Understanding the Role of a Commercial Loan Broker

Before diving into the steps of becoming a commercial loan broker, it's important to understand what the role entails. A commercial loan broker acts as an intermediary between borrowers and lenders, facilitating the process of securing loans for various business needs. This can range from purchasing real estate to financing equipment or working capital. Brokers leverage their knowledge of the market and relationships with lenders to find the best financing options for their clients.

#### Step 1: Gain Relevant Education and Experience

While there is no specific educational requirement to become a commercial loan broker, having a background in finance, business administration, or economics can be beneficial. Many successful brokers have degrees in these fields, as they provide a solid foundation of financial principles and business operations. Additionally, gaining experience in banking, finance, or real estate can enhance your understanding of the industry and improve your credibility with clients.

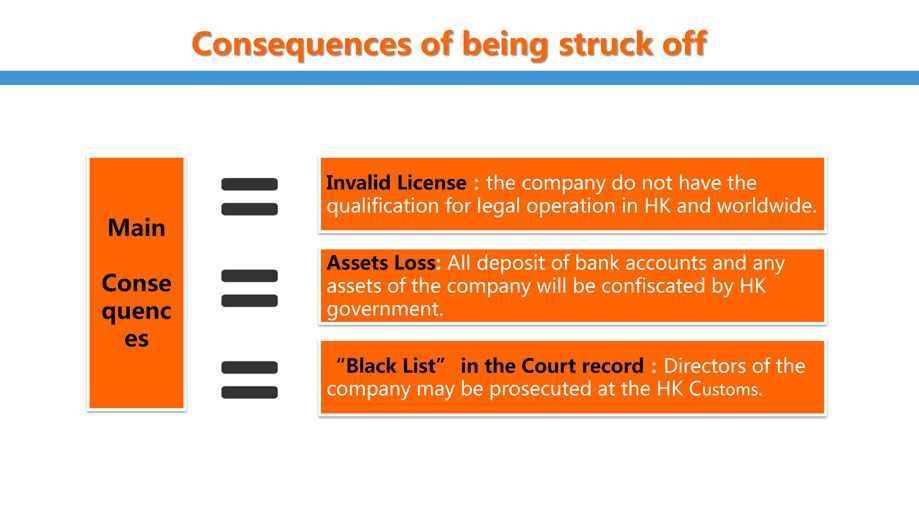

#### Step 2: Obtain Necessary Licenses and Certifications

In many jurisdictions, commercial loan brokers are required to obtain specific licenses to operate legally. This often includes a mortgage broker license or a business license, depending on your location. It's essential to research the licensing requirements in your area and complete any necessary training or examinations. Additionally, pursuing certifications from recognized organizations, such as the National Association of Mortgage Brokers (NAMB), can further establish your expertise and professionalism in the field.

#### Step 3: Build a Network of Lenders and Clients

Success as a commercial loan broker heavily relies on your ability to build and maintain relationships with both lenders and potential clients. Start by networking within the industry, attending finance-related events, and joining professional organizations. Establishing connections with various lenders will enable you to offer a wider range of financing options to your clients. Simultaneously, developing a strong client base will ensure a steady stream of business and referrals.

#### Step 4: Develop Your Marketing Strategy

To attract clients, you need to have a solid marketing strategy in place. This can include creating a professional website, utilizing social media platforms, and engaging in content marketing to showcase your expertise. Consider offering free resources, such as eBooks or webinars, that provide valuable information about commercial financing. These efforts can help establish your authority in the field and draw potential clients to your services.

#### Step 5: Stay Informed and Adapt to Market Changes

The commercial lending landscape is constantly evolving, with new regulations, trends, and market conditions affecting the availability of financing options. To remain competitive, it's crucial to stay informed about industry changes and continuously educate yourself. Attend workshops, read industry publications, and participate in online forums to keep your knowledge up to date. This commitment to learning will not only enhance your skills but also demonstrate your dedication to clients.

#### Conclusion

In summary, becoming a commercial loan broker requires a combination of education, licensing, networking, marketing, and ongoing education. By following these steps and remaining dedicated to your professional development, you can successfully launch a career in commercial financing. As you gain experience and build your reputation, you'll find that the opportunities for success in this field can be substantial. Whether you're helping businesses secure their first loan or facilitating complex financing deals, the role of a commercial loan broker is both challenging and rewarding.