Understanding What Credit Score is Needed for a Car Loan: Essential Insights for Car Buyers

**Translation of the phrase:** What credit score is needed for a car loan---When it comes to financing a vehicle, one of the most common questions prospecti……

**Translation of the phrase:** What credit score is needed for a car loan

---

When it comes to financing a vehicle, one of the most common questions prospective buyers ask is, what credit score is needed for a car loan? Understanding this aspect of car financing is crucial, as it can significantly influence not only your ability to secure a loan but also the interest rates and terms available to you.

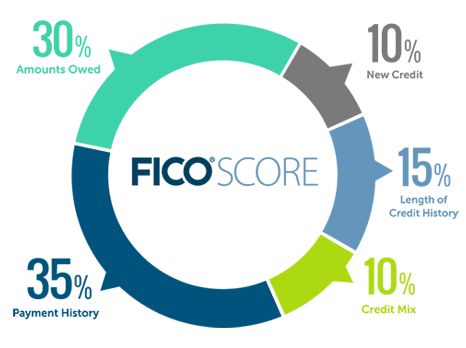

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Lenders use this score to assess the risk of lending money to you. In general, a higher credit score indicates a lower risk, which can lead to better loan terms. For car loans, the minimum credit score required can vary widely depending on the lender and the type of loan.

### The Minimum Credit Score for Car Loans

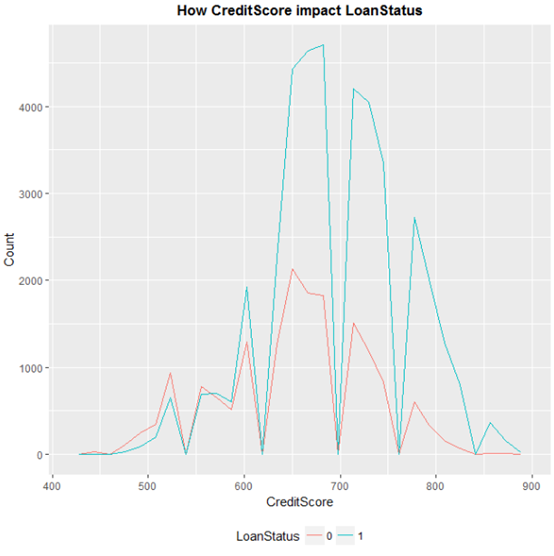

Most lenders typically require a credit score of at least 620 to qualify for a conventional car loan. However, if your credit score falls below this threshold, you may still have options. Some lenders specialize in providing loans to individuals with bad credit, meaning scores below 620. While these loans can be accessible, they often come with higher interest rates and less favorable terms.

### The Impact of Credit Score on Loan Terms

When you meet the minimum requirement of what credit score is needed for a car loan, you may find yourself eligible for a range of loan options. A credit score in the 700-749 range is generally considered good, and borrowers in this category can often secure loans with lower interest rates, potentially saving thousands over the life of the loan. Those with excellent credit scores, typically above 750, may even qualify for promotional financing offers, such as 0% APR for a limited time.

### Improving Your Credit Score

If you find that your credit score is below the required level, there are steps you can take to improve it before applying for a car loan. Here are some strategies:

1. **Check Your Credit Report:** Obtain a free copy of your credit report and review it for errors. Dispute any inaccuracies you find, as these can negatively impact your score.

2. **Pay Down Debts:** Reducing your credit card balances can lower your credit utilization ratio, which is a significant factor in your credit score.

3. **Make Payments on Time:** Consistently paying your bills on time is one of the most effective ways to boost your credit score.

4. **Avoid Opening New Accounts:** Each time you apply for credit, a hard inquiry is generated, which can temporarily lower your score. Avoid applying for new credit cards or loans before seeking a car loan.

5. **Consider a Secured Credit Card:** If your credit is poor, using a secured credit card responsibly can help you rebuild your credit history.

### Conclusion

In summary, knowing what credit score is needed for a car loan is essential for anyone looking to finance a vehicle. While a score of 620 is often the minimum required, striving for a higher score can unlock better loan terms and lower interest rates. By taking proactive steps to improve your credit, you can enhance your chances of securing a favorable car loan and ultimately save money in the long run. Whether you're a first-time buyer or looking to upgrade your vehicle, understanding your credit score and its impact on financing will empower you to make informed decisions.