How to Secure a Personal Loan with a 500 Credit Score: Tips and Options

#### Understanding 500 Credit Score Personal LoanA personal loan can be a vital financial tool, especially for individuals facing unexpected expenses or loo……

#### Understanding 500 Credit Score Personal Loan

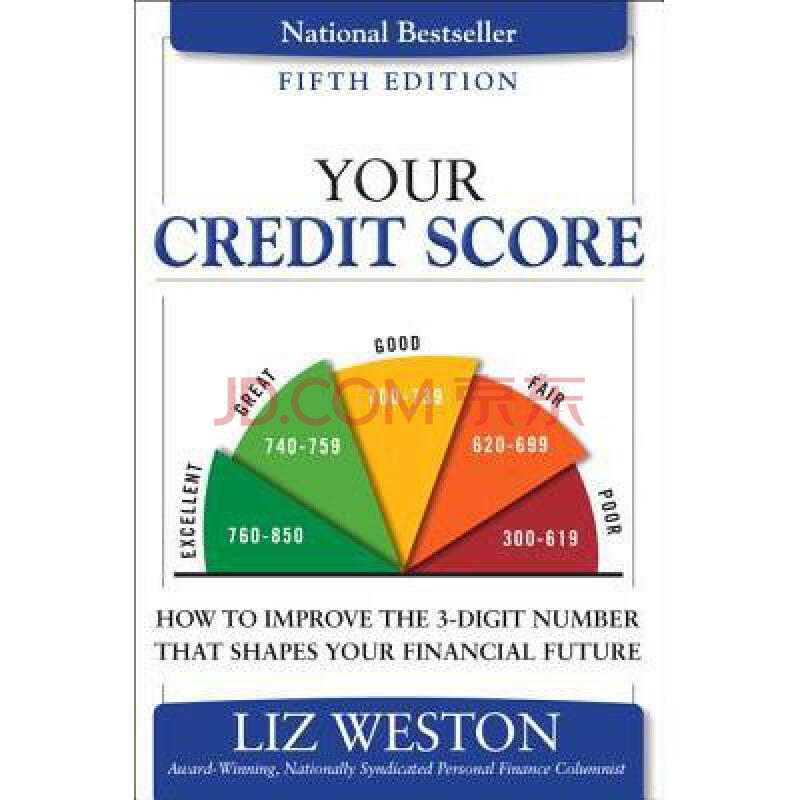

A personal loan can be a vital financial tool, especially for individuals facing unexpected expenses or looking to consolidate debt. However, obtaining a personal loan with a 500 credit score can be challenging. A credit score of 500 is generally considered poor, which means lenders may view you as a high-risk borrower. This can lead to higher interest rates, stricter terms, or even outright denial of your loan application.

#### Challenges of Getting a Personal Loan with a 500 Credit Score

When you apply for a personal loan with a 500 credit score, you may encounter several challenges. Lenders typically use credit scores to assess the likelihood that you will repay the loan. A low score may suggest that you have a history of missed payments, high debt levels, or other financial difficulties. As a result, lenders may be hesitant to approve your loan, fearing that you might default.

#### Options for Securing a Personal Loan

Despite these challenges, there are several options available for securing a personal loan with a 500 credit score. Here are some strategies to consider:

1. **Credit Unions**: Credit unions often have more lenient lending criteria than traditional banks. If you are a member of a credit union, you may have a better chance of securing a loan, even with a low credit score.

2. **Secured Loans**: Some lenders offer secured personal loans, which require collateral, such as a vehicle or savings account. By providing collateral, you may improve your chances of approval, as the lender has a form of security in case you default.

3. **Co-Signer**: Having a co-signer with a higher credit score can significantly increase your chances of getting approved for a loan. The co-signer agrees to take responsibility for the loan if you fail to make payments, which reduces the lender's risk.

4. **Peer-to-Peer Lending**: Online peer-to-peer lending platforms connect borrowers with individual investors. These platforms may be more willing to lend to those with lower credit scores, as they consider other factors beyond just credit history.

5. **Alternative Lenders**: Some online lenders specialize in providing loans to individuals with poor credit. While interest rates may be higher, these lenders may offer more flexible terms and approval processes.

#### Improving Your Chances of Approval

To enhance your chances of securing a personal loan with a 500 credit score, consider taking the following steps:

- **Check Your Credit Report**: Obtain a copy of your credit report and review it for errors. Disputing inaccuracies can help improve your score.

- **Reduce Debt**: Paying down existing debts can improve your credit utilization ratio, which may positively impact your credit score.

- **Build a Positive Payment History**: Make timely payments on existing debts to demonstrate your ability to manage credit responsibly.

- **Consider a Smaller Loan Amount**: Requesting a smaller loan may make it easier to get approved, as lenders may be more willing to take a risk on a lower amount.

#### Conclusion

While obtaining a personal loan with a 500 credit score can be difficult, it is not impossible. By exploring various options, improving your financial situation, and being proactive in your approach, you can increase your chances of securing the funds you need. Always remember to read the terms carefully and consider the long-term implications of taking on debt, especially at higher interest rates. With the right strategy, you can navigate the challenges of borrowing and work towards improving your credit score for future financial opportunities.