Understanding Car Loan Value: How to Maximize Your Investment in a Vehicle

#### What is Car Loan Value?Car loan value refers to the amount of money you can borrow to finance the purchase of a vehicle. This value is determined by se……

#### What is Car Loan Value?

Car loan value refers to the amount of money you can borrow to finance the purchase of a vehicle. This value is determined by several factors, including the price of the car, your credit score, the loan term, and the interest rate. Understanding car loan value is crucial for making informed decisions when purchasing a vehicle, as it directly affects your monthly payments and the total cost of the loan.

#### Factors Influencing Car Loan Value

Several key factors influence the car loan value you may qualify for:

1. **Vehicle Price**: The total cost of the vehicle is the most significant factor. If you're purchasing a new car, the MSRP (Manufacturer's Suggested Retail Price) will be your starting point. For used cars, the value may be determined by the vehicle's condition, mileage, and market demand.

2. **Credit Score**: Your credit score plays a vital role in determining your car loan value. A higher credit score typically means lower interest rates, which can increase the amount you can borrow. Lenders use your credit score to assess your creditworthiness and the risk of lending you money.

3. **Loan Term**: The length of the loan also affects the car loan value. Shorter loan terms usually come with higher monthly payments but lower overall interest costs. Conversely, longer loan terms can lower your monthly payments but may increase the total interest paid over the life of the loan.

4. **Interest Rates**: The interest rate you receive on your car loan directly impacts the total cost of the loan. Rates can vary based on market conditions, your credit score, and the lender's policies. A lower interest rate can significantly enhance your car loan value.

5. **Down Payment**: Making a larger down payment can reduce the amount you need to finance, thereby influencing your car loan value. A substantial down payment not only lowers your loan amount but can also improve your chances of securing favorable loan terms.

#### How to Maximize Your Car Loan Value

To ensure you get the most value from your car loan, consider the following strategies:

1. **Improve Your Credit Score**: Before applying for a loan, check your credit report for errors and take steps to improve your credit score. Pay down existing debts, make payments on time, and avoid taking on new debt shortly before applying for a loan.

2. **Shop Around for Lenders**: Different lenders offer various terms and rates. Take the time to compare offers from banks, credit unions, and online lenders. Use pre-qualification tools to gauge your potential car loan value without impacting your credit score.

3. **Negotiate the Price of the Car**: The car's purchase price is a significant factor in determining your loan value. Don't hesitate to negotiate with the dealer or seller to get the best possible price. Research the market value of the vehicle to ensure you're paying a fair price.

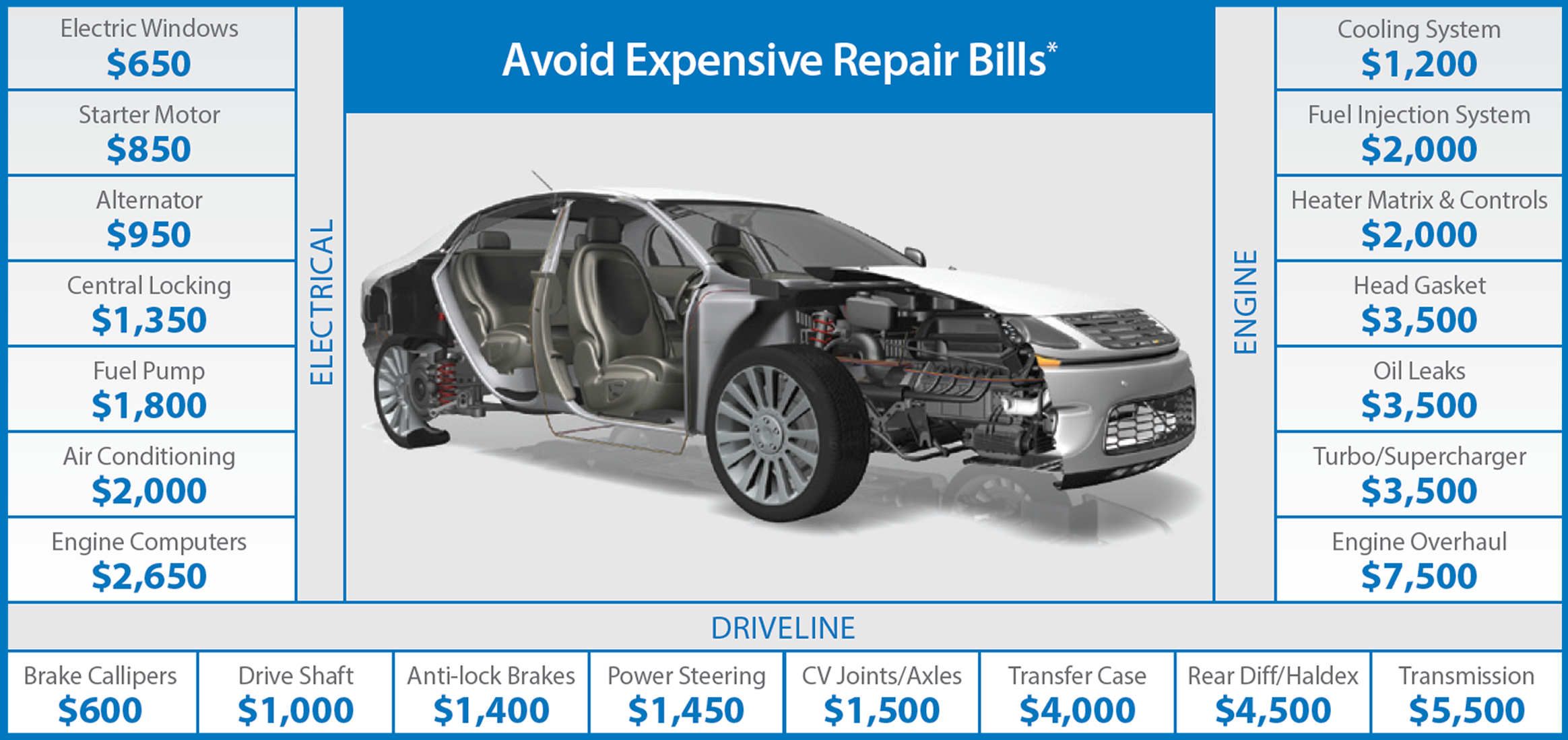

4. **Consider the Total Cost of Ownership**: When evaluating a car loan, consider not just the monthly payment but also the total cost of ownership, including insurance, maintenance, fuel, and depreciation. Selecting a vehicle with lower ownership costs can enhance your overall investment.

5. **Choose the Right Loan Term**: Evaluate your budget and financial goals when selecting a loan term. If you can afford higher monthly payments, a shorter loan term may save you money on interest. Conversely, if you need lower payments, a longer term might be more suitable, but be aware of the total interest costs.

#### Conclusion

Understanding car loan value is essential for anyone looking to finance a vehicle. By considering the factors that influence loan value and employing strategies to maximize it, you can make a more informed decision that aligns with your financial goals. Whether you're purchasing a new car or a used one, being knowledgeable about car loan value can help you save money and make the most of your investment.