"Ultimate Guide to Consolidation for Student Loans: Simplify Your Debt Management Today!"

---#### Understanding Consolidation for Student LoansConsolidation for student loans refers to the process of combining multiple student loans into a single……

---

#### Understanding Consolidation for Student Loans

Consolidation for student loans refers to the process of combining multiple student loans into a single loan, allowing borrowers to simplify their monthly payments and potentially lower their interest rates. This financial strategy can be particularly beneficial for graduates who have taken out several loans during their education, as it streamlines the repayment process and can ease the burden of managing multiple payments.

#### Benefits of Consolidation for Student Loans

One of the primary advantages of consolidation for student loans is the convenience it offers. Instead of juggling multiple due dates and amounts, borrowers can focus on a single monthly payment. This can significantly reduce the stress associated with managing multiple loans and help borrowers stay on track with their repayment plans.

Additionally, consolidation can lead to lower interest rates. While the new interest rate is typically a weighted average of the original loans, borrowers may find that consolidating their loans can lead to a more manageable rate, especially if they have variable-rate loans. This can result in substantial savings over the life of the loan.

#### Eligibility for Consolidation for Student Loans

Not all student loans are eligible for consolidation. Federal student loans can be consolidated through a Direct Consolidation Loan, which is offered by the U.S. Department of Education. However, private student loans may require borrowers to work with private lenders for consolidation options. It’s essential for borrowers to research their specific loans and understand the eligibility requirements before proceeding.

#### How to Consolidate Your Student Loans

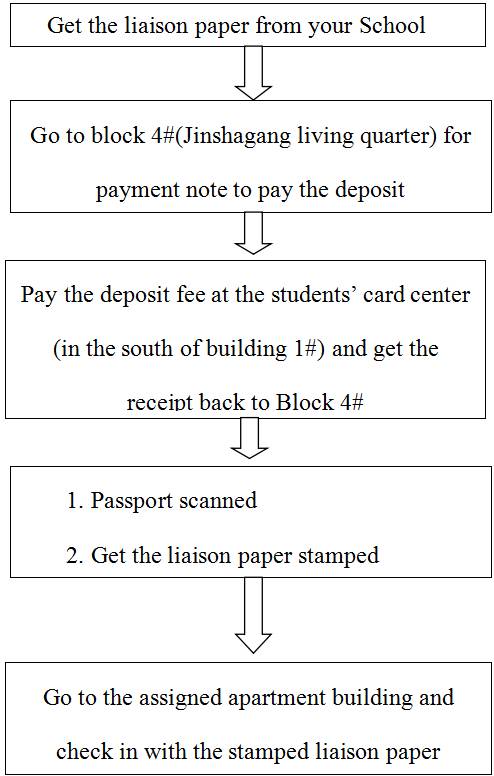

The process of consolidating student loans typically involves several steps:

1. **Gather Information**: Collect all loan details, including the types of loans, outstanding balances, interest rates, and repayment terms.

2. **Research Options**: Explore the different consolidation options available, both federal and private. Compare interest rates, repayment terms, and any potential fees associated with consolidation.

3. **Apply for Consolidation**: For federal loans, complete the Direct Consolidation Loan application through the Department of Education’s website. For private loans, contact your chosen lender to initiate the process.

4. **Review Terms**: Carefully review the terms of the new consolidated loan, including the interest rate, repayment period, and any potential benefits or drawbacks.

5. **Finalize the Process**: Once you agree to the terms, finalize the consolidation. Ensure that all previous loans are paid off and that you understand your new repayment schedule.

#### Considerations Before Consolidating for Student Loans

While consolidation for student loans can offer numerous benefits, it’s essential to consider potential drawbacks. For instance, consolidating federal loans may result in the loss of certain borrower benefits, such as interest rate discounts or loan forgiveness programs. Additionally, extending the repayment term can lead to paying more interest over time, even if the monthly payments are lower.

#### Conclusion

Consolidation for student loans can be a powerful tool for managing educational debt. By simplifying payments and potentially lowering interest rates, borrowers can gain greater control over their financial futures. However, it’s crucial to weigh the pros and cons and explore all available options before making a decision. With careful planning and consideration, consolidation can pave the way for a more manageable and less stressful repayment experience.