A Comprehensive Guide on How to Defer Student Loan Payments: Tips and Strategies for Financial Relief

#### Understanding How to Defer Student Loan PaymentsWhen faced with financial challenges, many borrowers seek ways to manage their student loans effectivel……

#### Understanding How to Defer Student Loan Payments

When faced with financial challenges, many borrowers seek ways to manage their student loans effectively. One of the most common strategies is learning **how to defer student loan payments**. Deferment allows borrowers to temporarily pause their loan payments, providing much-needed relief during difficult times. This guide will explore the various aspects of deferment, the eligibility criteria, and the steps to take advantage of this option.

#### What is Deferment?

**How to defer student loan payments** refers to the process of postponing payments on your student loans without accruing interest on certain types of loans. This can be particularly beneficial for federal loans, such as Direct Subsidized Loans and Federal Perkins Loans. During deferment, borrowers are not required to make monthly payments, and in some cases, the government covers the interest.

#### Eligibility for Deferment

Not all borrowers qualify for deferment. Understanding the eligibility criteria is crucial. Here are some common reasons that may allow you to defer your student loans:

1. **In-school Status**: If you are enrolled at least half-time in an eligible college or university, you can defer payments until you graduate or drop below half-time status.

2. **Unemployment**: If you are unemployed or unable to find full-time work, you may qualify for a deferment for up to three years.

3. **Economic Hardship**: Borrowers experiencing financial difficulties may be eligible for deferment. This includes those receiving public assistance or those whose income falls below the poverty line.

4. **Military Service**: Active duty military members can defer payments while serving.

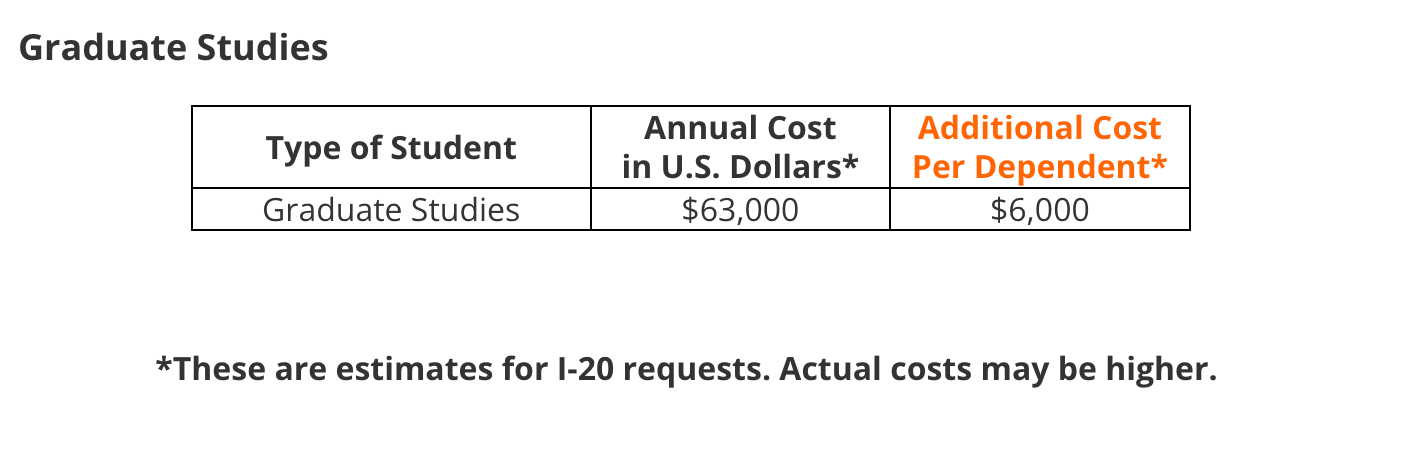

5. **Graduate School**: If you are pursuing graduate studies, you may also qualify for deferment.

#### Steps to Defer Student Loan Payments

If you believe you qualify for deferment, follow these steps to initiate the process:

1. **Contact Your Loan Servicer**: Reach out to your loan servicer to discuss your situation and confirm your eligibility for deferment.

2. **Complete the Application**: Your servicer will provide you with a deferment application form. Fill it out completely, providing any necessary documentation to support your request.

3. **Submit the Application**: Send your completed application to your loan servicer. Make sure to keep a copy for your records.

4. **Await Confirmation**: Your servicer will review your application and notify you of their decision. If approved, they will provide you with the details regarding the deferment period.

5. **Stay Informed**: Keep track of your deferment status and any deadlines. It’s essential to maintain communication with your loan servicer throughout the process.

#### Implications of Deferment

While deferment can provide immediate financial relief, it’s essential to consider the long-term implications. For subsidized loans, interest does not accrue during deferment. However, for unsubsidized loans, interest will continue to accumulate, increasing the total amount you owe once the deferment period ends.

#### Conclusion

Learning **how to defer student loan payments** can be a valuable tool for managing student debt during challenging times. By understanding the eligibility requirements, the application process, and the potential impacts on your loans, you can make informed decisions about your financial future. Always consult with your loan servicer and explore all available options to ensure you choose the best path for your circumstances.