Understanding Loan Advance Insurance and Its Impact on CPI: What You Need to Know

#### LoanIn the modern financial landscape, loans have become a pivotal component for individuals and businesses alike. They serve as a means to acquire nec……

#### Loan

In the modern financial landscape, loans have become a pivotal component for individuals and businesses alike. They serve as a means to acquire necessary funds for various purposes, from purchasing a home to financing a business venture. Understanding the different types of loans available, their terms, and conditions is crucial for making informed financial decisions.

#### Advance

The term "advance" in the context of loans often refers to the upfront disbursement of funds that borrowers receive. This can include personal loans, business loans, or even advances on credit cards. Borrowers must be aware of the implications of taking an advance, including interest rates, repayment schedules, and potential fees. An advance can provide immediate financial relief, but it is essential to manage it wisely to avoid falling into debt.

#### Insurance

Insurance plays a vital role in financial security, especially when it comes to loans. Loan advance insurance is a type of coverage designed to protect borrowers in the event of unforeseen circumstances that may prevent them from repaying their loans. This insurance can cover various scenarios, such as job loss, disability, or critical illness. By having loan advance insurance, borrowers can safeguard their financial future and ensure that they are not burdened with debt during challenging times.

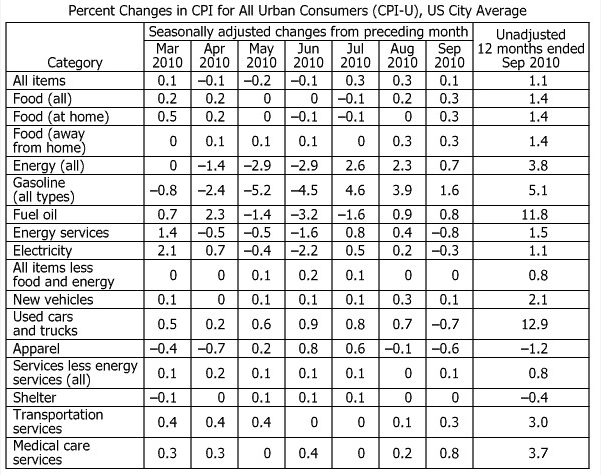

#### CPI (Consumer Price Index)

The Consumer Price Index (CPI) is a critical economic indicator that measures the average change over time in the prices paid by consumers for goods and services. It reflects inflation and the cost of living, influencing interest rates and loan terms. Understanding how CPI affects loans and insurance is essential for borrowers. For instance, if the CPI rises significantly, it may lead to higher interest rates on loans, making borrowing more expensive. Conversely, a stable or declining CPI can create favorable borrowing conditions.

### Detailed Description

In today’s economy, the interplay between loan advance insurance and the Consumer Price Index (CPI) is more significant than ever. As borrowers seek financial assistance through various loan products, understanding the implications of loan advance insurance becomes crucial. This type of insurance not only provides peace of mind but also plays a vital role in managing the financial risks associated with borrowing.

Loan advance insurance acts as a safety net for borrowers. It ensures that in the event of unexpected life changes, such as losing a job or facing a health crisis, individuals can still meet their loan obligations. This is particularly important in volatile economic climates where job security may be uncertain. By having this insurance, borrowers can avoid defaulting on their loans, which can have long-term repercussions on their credit scores and financial stability.

Moreover, the relationship between loan advance insurance and CPI cannot be overlooked. As the CPI fluctuates, it directly impacts borrowing costs. For instance, an increase in CPI often signals rising inflation, leading lenders to adjust interest rates accordingly. This means that borrowers may face higher costs when taking out loans, making it even more critical to have loan advance insurance to mitigate potential financial strain.

In conclusion, understanding the dynamics of loan advance insurance and its connection to the Consumer Price Index is essential for anyone considering taking out a loan. By being informed about these factors, borrowers can make smarter financial decisions, ensuring that they are protected against unforeseen circumstances while navigating the complexities of the lending landscape. As the economy continues to evolve, staying educated about these topics will empower individuals to manage their finances effectively and secure their financial futures.