Understanding the Implications: Are SBA Loans Dischargeable in Bankruptcy?

#### Are SBA Loans Dischargeable in Bankruptcy?When facing financial difficulties, many individuals and businesses may consider bankruptcy as a potential so……

#### Are SBA Loans Dischargeable in Bankruptcy?

When facing financial difficulties, many individuals and businesses may consider bankruptcy as a potential solution. However, one common question arises: **Are SBA loans dischargeable in bankruptcy?** This inquiry is particularly relevant for small business owners who have utilized Small Business Administration (SBA) loans to fund their operations. In this article, we will delve into the nuances of SBA loans, the bankruptcy process, and the potential for discharge.

#### The Nature of SBA Loans

SBA loans are government-backed loans designed to assist small businesses in obtaining financing that they might not qualify for through traditional lending institutions. These loans come with favorable terms and lower interest rates, making them an attractive option for entrepreneurs. However, the government backing also means that there are specific regulations and stipulations regarding these loans.

#### Bankruptcy Overview

Bankruptcy is a legal process that allows individuals or businesses to eliminate or repay their debts under the protection of the federal bankruptcy court. There are different types of bankruptcy, with Chapter 7 and Chapter 13 being the most common for individuals. Chapter 7 involves liquidating assets to pay creditors, while Chapter 13 allows for a repayment plan over three to five years.

#### Dischargeability of SBA Loans

The crucial aspect of the question **Are SBA loans dischargeable in bankruptcy?** lies in understanding how the bankruptcy process treats these loans. Generally, most unsecured debts can be discharged in bankruptcy, meaning the borrower is no longer legally obligated to repay them. However, SBA loans often come with personal guarantees from the business owner, which complicates matters.

1. **Personal Guarantees**: When a business owner signs a personal guarantee for an SBA loan, they are personally liable for the debt. In a Chapter 7 bankruptcy, while the business's debts may be discharged, the personal guarantee means that the individual may still be responsible for repaying the loan if the debt is not treated as unsecured.

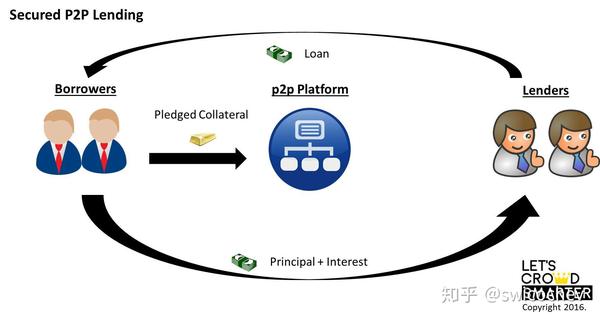

2. **Secured vs. Unsecured Debt**: If the SBA loan is secured by collateral, such as real estate or equipment, the lender may have the right to reclaim that collateral even after bankruptcy. This means that while the borrower may discharge some of the debt, they could still lose the assets tied to the loan.

3. **Fraudulent Activity**: If the borrower engaged in fraudulent activities to obtain the loan or misrepresented their financial situation, the loan may not be dischargeable. Creditors can challenge the dischargeability of the debt in bankruptcy court.

#### Seeking Legal Advice

Given the complexities surrounding the dischargeability of SBA loans in bankruptcy, it is crucial for borrowers to seek legal advice. A bankruptcy attorney can provide guidance tailored to individual circumstances, helping borrowers understand their rights and options.

#### Conclusion

In conclusion, the question **Are SBA loans dischargeable in bankruptcy?** does not have a straightforward answer. The dischargeability largely depends on factors such as personal guarantees, the nature of the debt (secured vs. unsecured), and the circumstances surrounding the loan. As small business owners navigate the challenges of financial distress, understanding these nuances is vital for making informed decisions. Consulting with a legal expert can provide clarity and support throughout the bankruptcy process.