Understanding Home Loan Interest Rates for 15-Year Mortgages: What You Need to Know

#### Home Loan Interest Rates 15 YearWhen considering purchasing a home, one of the most crucial factors to understand is the home loan interest rates 15 ye……

#### Home Loan Interest Rates 15 Year

When considering purchasing a home, one of the most crucial factors to understand is the home loan interest rates 15 year. These rates can significantly impact your monthly payments and the overall cost of your mortgage. A 15-year mortgage typically offers lower interest rates compared to a 30-year mortgage, making it an attractive option for many homebuyers. However, it’s essential to grasp how these rates work and what influences them.

#### What are Home Loan Interest Rates?

Home loan interest rates refer to the cost of borrowing money to purchase a home. These rates can vary based on several factors, including the lender, the borrower's credit score, and the overall economic environment. For a 15-year mortgage, the interest rate is fixed for the entire duration of the loan, providing stability in monthly payments.

#### Advantages of 15-Year Mortgages

One of the main advantages of opting for a 15-year mortgage is the lower interest rate. Generally, home loan interest rates 15 year are about 0.5% to 1% lower than those for 30-year loans. This means that not only will you pay less in interest over the life of the loan, but you will also build equity in your home much faster. Additionally, a shorter loan term means you will be debt-free sooner, allowing you to allocate your finances towards other investments or retirement savings.

#### Factors Affecting Home Loan Interest Rates 15 Year

Several factors can influence the home loan interest rates 15 year:

1. **Credit Score**: Lenders use your credit score to assess your risk level. A higher credit score can qualify you for lower interest rates.

2. **Loan Amount**: The size of your mortgage can also affect the interest rate. Larger loans may come with slightly higher rates due to increased risk.

3. **Down Payment**: A larger down payment reduces the lender's risk and can lead to a lower interest rate.

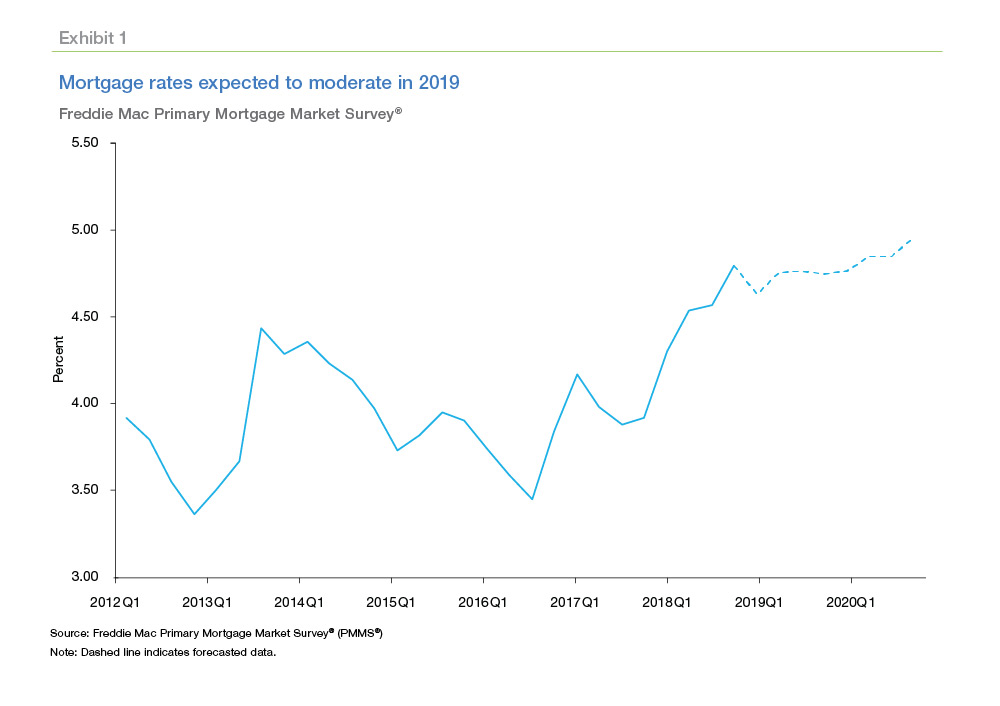

4. **Market Conditions**: Economic factors, such as inflation and the Federal Reserve's monetary policy, can also affect mortgage rates.

5. **Type of Lender**: Different lenders may offer varying rates based on their business models and risk assessments.

#### How to Secure the Best Home Loan Interest Rates 15 Year

To secure the best home loan interest rates 15 year, consider the following tips:

- **Improve Your Credit Score**: Before applying for a mortgage, check your credit report for errors and work on improving your score by paying down debts and making payments on time.

- **Shop Around**: Don’t settle for the first offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

- **Consider Locking in Your Rate**: If you find a favorable rate, ask your lender if you can lock it in, especially if you anticipate rates will rise.

- **Negotiate**: Don’t be afraid to negotiate with lenders. They may be willing to lower their rates or fees to secure your business.

#### Conclusion

Understanding home loan interest rates 15 year is vital for any prospective homebuyer. With the potential for lower rates and faster equity building, a 15-year mortgage can be an excellent choice for many. By considering the factors that influence these rates and taking steps to improve your financial profile, you can secure a favorable mortgage that aligns with your long-term financial goals. Always remember to do thorough research and consult with financial advisors to make informed decisions about your home financing options.