"Unlock Your Dream Home: How to Secure a Loan to Buy a House in Today's Market"

#### Understanding the Loan to Buy a HouseWhen it comes to purchasing a home, understanding the nuances of a **loan to buy a house** is essential. This fina……

#### Understanding the Loan to Buy a House

When it comes to purchasing a home, understanding the nuances of a **loan to buy a house** is essential. This financial instrument allows prospective homeowners to borrow money from banks or financial institutions to purchase real estate. The borrowed amount is then repaid over time, typically with interest, making it a feasible option for many individuals looking to own a piece of property.

#### The Types of Loans Available

There are various types of loans available for buying a house, including conventional loans, FHA loans, VA loans, and USDA loans. Each type has its own set of requirements, advantages, and disadvantages. For instance, FHA loans are designed for first-time homebuyers and require a lower down payment, while VA loans cater specifically to veterans and active-duty military members, offering favorable terms.

#### How to Qualify for a Loan to Buy a House

Qualifying for a **loan to buy a house** involves several factors, including your credit score, income level, debt-to-income ratio, and employment history. Lenders will assess these aspects to determine your eligibility and the amount you can borrow. It's crucial to check your credit report and address any issues before applying for a loan, as a higher credit score can lead to better interest rates and terms.

#### The Importance of Down Payments

One of the most significant aspects of securing a **loan to buy a house** is the down payment. This upfront payment is typically a percentage of the home's purchase price and can vary depending on the type of loan. A larger down payment can reduce your monthly mortgage payments and may even eliminate the need for private mortgage insurance (PMI), which is often required for loans with lower down payments.

#### Navigating the Loan Application Process

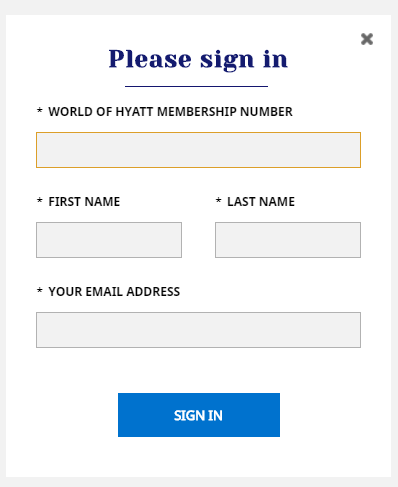

The application process for a **loan to buy a house** can be daunting, but understanding the steps involved can ease the journey. Start by gathering necessary documents, including proof of income, tax returns, and information about your debts and assets. Once your application is submitted, the lender will review your financial information and may request additional documentation. Be prepared for a home appraisal and inspection, as these are standard procedures before finalizing the loan.

#### Interest Rates and Loan Terms

Interest rates play a crucial role in the overall cost of your **loan to buy a house**. These rates can fluctuate based on market conditions and your financial profile. It's essential to shop around and compare offers from different lenders to find the most favorable terms. Additionally, consider whether a fixed or adjustable-rate mortgage is the best fit for your financial situation.

#### Closing Costs and What to Expect

When securing a **loan to buy a house**, it's important to factor in closing costs, which can range from 2% to 5% of the purchase price. These costs include fees for the loan origination, appraisal, title insurance, and other related expenses. Understanding these costs upfront can help you budget more effectively and avoid surprises at closing.

#### Final Thoughts

Securing a **loan to buy a house** is a significant step in your journey to homeownership. By understanding the types of loans available, qualifying criteria, and the application process, you can navigate the complexities of home buying with confidence. Remember to conduct thorough research, seek advice from financial professionals, and make informed decisions to ensure a smooth transition into your new home. With the right preparation and knowledge, your dream home can become a reality.