Exploring Popular Payday Loan Apps Like Dave: Your Guide to Quick Cash Solutions

#### Introduction to Payday Loan Apps Like DaveIn today's fast-paced world, unexpected expenses can arise at any moment, leaving many individuals in need of……

#### Introduction to Payday Loan Apps Like Dave

In today's fast-paced world, unexpected expenses can arise at any moment, leaving many individuals in need of quick financial solutions. One popular option is payday loan apps like Dave, which provide users with a convenient way to access cash when they need it most. In this article, we'll delve into what payday loan apps are, how they work, and explore alternatives to Dave that can help you manage your financial needs effectively.

#### What Are Payday Loan Apps?

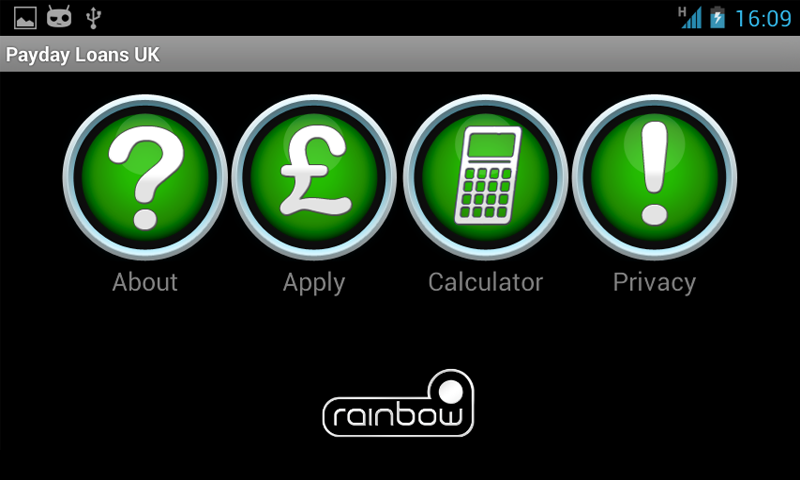

Payday loan apps are mobile applications designed to offer short-term loans to individuals who may be facing financial emergencies. These apps typically allow users to borrow small amounts of money, which they are expected to repay by their next payday. The convenience of these apps lies in their accessibility; users can apply for loans directly from their smartphones without the need for lengthy paperwork or in-person visits to a lender.

#### How Do Payday Loan Apps Like Dave Work?

Payday loan apps like Dave operate by assessing a user's financial situation through their banking information. Users link their bank accounts to the app, allowing it to analyze their income and spending patterns. Based on this analysis, the app determines the amount of money the user can borrow. Once approved, funds are usually deposited into the user's bank account within a short period, often within a day.

#### The Benefits of Using Payday Loan Apps

1. **Quick Access to Funds**: One of the primary advantages of payday loan apps is the speed at which users can access funds. This is particularly beneficial for those facing urgent expenses, such as medical bills or car repairs.

2. **User-Friendly Interface**: Most payday loan apps are designed to be intuitive and easy to navigate, making the borrowing process straightforward for users of all ages.

3. **Flexible Repayment Options**: Many apps offer flexible repayment terms, allowing users to choose a repayment plan that fits their financial situation.

4. **No Credit Check Required**: Unlike traditional lenders, payday loan apps often do not require a credit check, making them accessible to individuals with less-than-perfect credit scores.

#### Alternatives to Payday Loan Apps Like Dave

While payday loan apps like Dave offer a convenient solution for short-term financial needs, it's essential to consider alternatives that may provide better terms and lower fees:

1. **Credit Unions**: Many credit unions offer small personal loans with lower interest rates and more favorable repayment terms than payday loan apps.

2. **Peer-to-Peer Lending**: Platforms that facilitate peer-to-peer lending can connect borrowers with individual lenders, often resulting in lower interest rates compared to traditional payday loans.

3. **Cash Advance from Credit Cards**: If you have a credit card, you may be able to take a cash advance at a lower interest rate than a payday loan.

4. **Emergency Savings**: Building an emergency savings fund can help you avoid the need for payday loans altogether. Even a small amount set aside each month can provide a financial cushion for unexpected expenses.

#### Conclusion

In conclusion, payday loan apps like Dave offer a quick and convenient solution for individuals facing financial emergencies. However, it's crucial to be aware of the potential pitfalls, such as high fees and interest rates, associated with these loans. By exploring alternatives and making informed financial decisions, you can better manage your financial health and avoid the cycle of debt that often accompanies payday loans. Always remember to read the terms and conditions thoroughly and consider your ability to repay before borrowing.