How to Effectively Calculate Your Mortgage Loan: A Comprehensive Guide for Homebuyers

#### Understanding Mortgage LoansWhen it comes to purchasing a home, understanding mortgage loans is essential. A mortgage loan is a type of loan specifical……

#### Understanding Mortgage Loans

When it comes to purchasing a home, understanding mortgage loans is essential. A mortgage loan is a type of loan specifically used to buy real estate. The borrower agrees to pay back the loan amount, plus interest, over a specified period, typically 15 to 30 years. Knowing how to calculate your mortgage loan will enable you to make informed decisions regarding your home purchase.

#### What is the Importance of Calculating Your Mortgage Loan?

Calculating your mortgage loan helps you understand how much you can afford to borrow and what your monthly payments will be. This calculation takes into account various factors, including the loan amount, interest rate, and loan term. By having a clear understanding of these elements, you can avoid financial strain and ensure that your mortgage fits within your budget.

#### Key Factors to Consider

When you calculate your mortgage loan, consider the following key factors:

1. **Loan Amount**: This is the total amount you intend to borrow. It is crucial to determine how much you need based on the price of the home and your down payment.

2. **Interest Rate**: The interest rate significantly affects your monthly payment and the total amount paid over the life of the loan. Rates can vary based on market conditions and your credit score.

3. **Loan Term**: The length of time you have to repay the loan can range from 10 to 30 years. Shorter terms usually come with higher monthly payments but lower total interest paid.

4. **Down Payment**: The amount you pay upfront can affect your loan amount and whether you need to pay private mortgage insurance (PMI). A larger down payment typically leads to better loan terms.

#### How to Calculate Your Mortgage Loan

To calculate your mortgage loan, you can use a simple formula or an online mortgage calculator. The formula for calculating monthly mortgage payments (M) is:

\[ M = P \times \frac{r(1 + r)^n}{(1 + r)^n - 1} \]

Where:

- **M** = Monthly payment

- **P** = Principal loan amount

- **r** = Monthly interest rate (annual rate divided by 12)

- **n** = Number of payments (loan term in months)

For example, if you are borrowing $300,000 at a 4% annual interest rate for 30 years, the monthly interest rate would be 0.00333 (4% / 12), and the total number of payments would be 360 (30 years × 12 months). Plugging these values into the formula will give you your monthly payment.

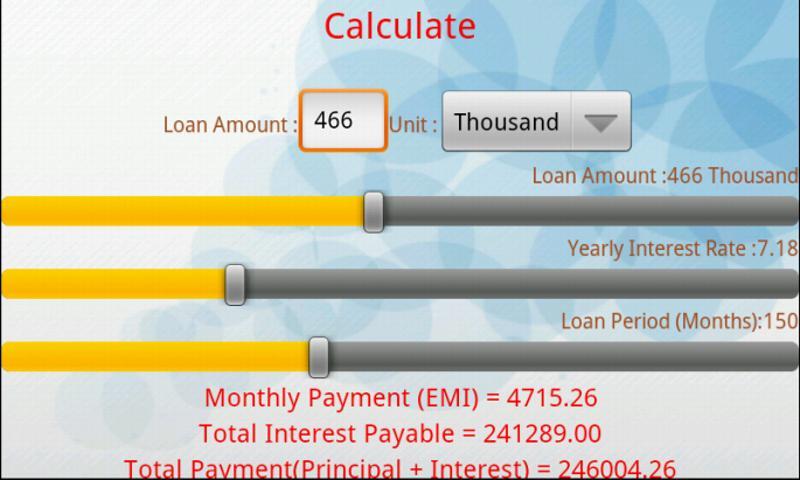

#### Using Online Calculators

If you prefer a more user-friendly approach, many online mortgage calculators can help you calculate your mortgage loan. These tools allow you to input your loan amount, interest rate, and loan term, providing you with an instant monthly payment estimate. They can also show you the total interest paid over the life of the loan, helping you make better financial decisions.

#### Conclusion

Calculating your mortgage loan is a critical step in the home-buying process. By understanding the components that influence your mortgage, you can make informed decisions that align with your financial goals. Whether you choose to use a formula or an online calculator, being proactive in this aspect will help you secure a mortgage that fits your needs and budget. Take the time to calculate your mortgage loan accurately, and you’ll be one step closer to owning your dream home.